For the website Financial Poise, Metropolis Collectibles COO Vincent Zurzolo wrote a piece entitled "Should You Invest in Comic Books? Top Tips From A Comic Book Investor" which guides (presumably) those unfamiliar with comics into the complicated world of comic book investing.

Understanding that I am likely not the target audience for this type of piece - much of the information is for beginners - I found that some of the information and advice in this piece could be anywhere from confusing to downright misleading for those new to comic book investing.

Let's dive in and look at why.

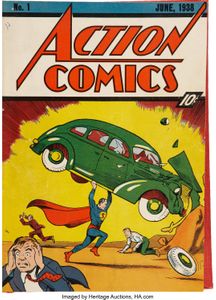

The Opportunity: Comics as an Alternate Investment

From the title of the article, if I'm someone new to comics and researching it as an investment opportunity, I'm looking for whether it is a worthwhile opportunity. Give it to me straight, comic expert.

"Given the current uncertainty of the stock market, many investors have started considering investing in alternative assets, such as real estate, gold, or cryptocurrency. For those seeking a fun, tangible way to diversify their portfolio, investing in comic books could be the answer."

The truth is, comics and comic art have been an appreciable asset for decades and have been proven to be a worthy investment even in times of recession. Most modern investment theories espouse diversification not just among different types of stocks or funds, but among different types of assets. That's why investing in real estate, sports cards, and cryptocurrencies is so hot right now.

If the question is should I invest in comics as a long-term strategy, the right answer is Yes.

The Catch: Do I Have to Invest in Only Expensive, Old Comic Books?

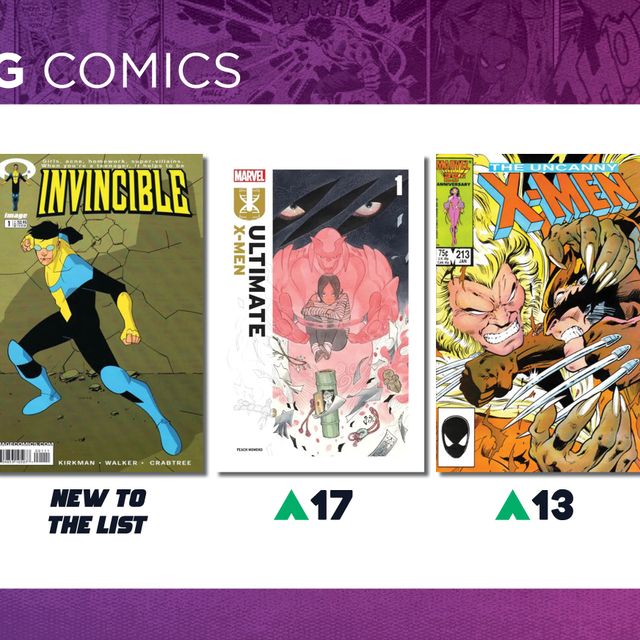

According to Mr. Zurzolo, we don't have to dive just into Golden and Silver Age grails. Even modern books can serve as suitable investment pieces as these also appreciate in value, and are/were considerably cheaper to acquire.

"But it’s not just the older books that are valuable. Comics from the last 20 years are also becoming collectible. Some have jumped in value from a few dollars just five years ago to $50 to $100 today. For example, consider Walking Dead #1, which was published in 2003 and is currently valued at over $2,000 today. This makes investing in comic books a potentially lucrative investment choice."

Let me count the ways The Walking Dead is a miserable example in this circumstance. There are literally dozens of Zombie-focused graphic novels in existence. Since we can't Marty McFly this thing and go back in time to grab a cheap

So yes, if we somehow knew back in 2003 or 2004 that this one particular book would grab the attention not only of graphic novel fans but also of television executives to become a phenomenon, we could have purchased it and made a handsome profit.

But how about we avoid recommending investment vehicles that relied on a 10-season television show with two spin-offs to drive its value? Unless you have inside information, pinning your investment strategy on speculating modern books is a dangerous game. Spider-Man and X-Men were skyrocketing in value before the movies, you know?

The Decision: What Type of Investor Do You Want To Be?

This is a great question! Thanks for considering it, Mr. Zurzolo. Do I want to be a flipper, earning modest gains here and there, or is this a more long-term strategy, to hold and let value explode over time? Let's check his answer on how to best answer this question.

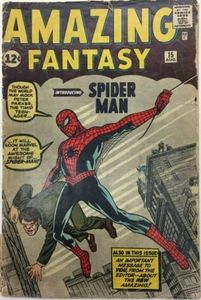

"Long-term investors should consider selecting comics that have traditionally shown slow, steady growth. For them, pre-1985 books are the best choice. These are comic books that have appreciated in value over time, and will likely continue to do so. For example, in 2010, people who bought a $3,000 copy of Amazing Fantasy #15 (1962), which marked the first appearance of Spider-Man, could see that same comic book worth $140,000 today."

What?

Now we are just bordering on irresponsibility here giving people ideas that they can receive a 45x return on their investment in 10 years.

We can dig into GoCollect's database for sales of Amazing Fantasy #15 over the last 10 years. A copy worth $140,000 today would be approximately a CGC 7.5 - a fair market value of $130,000 today. Looking back 10 years ago, a copy in that grade would have cost anywhere between $35,00 and $50,000.

A copy of AF#15 that would have cost $3,000 in 2010 would most likely have been a CGC 1.0-1.5. The highest a copy in those grades have sold for recently is $12,500. That's an amazing 4x return on investment in 10 years, but nowhere near the amount Mr. Zurzolo quotes.

Is it possible someone out there found a $3,000 copy in 2010 and sold it recently for $141,000? Sure. But when you are talking long-term comic book investing advice, it's probably better to stick to rules rather than exceptions.

The Risk: Some Not So Brilliant Short-Term Advice

What about the short-term market for expensive hot books? That is a careful calculation, according to Mr. Zurzolo, and one where caution must be practiced.

"But remember, the short-term market can be very volatile, and these purchases are more of a risk. For example, speculators who bought Green Lantern #7 a year before the Green Lantern movie came out in 2011 saw potentially huge profits, but only if they sold within a few months. If they waited until too close to the movie premiere, they probably ended up losing money, because the movie was a flop."

I can only presume he is talking about Green Lantern #7 from 1961, the first appearance of Sinestro (who was in the 2011 film.) The problem is the math doesn't add up, my friend.

If I pull data for a CGC 5.0 - the 50th percentile of copies available - there are no recorded sales before 2012, and the sales that are recorded after that date all show a value increase. I'm not sure if by "short-term investment" my collectible comrade Mr. Zurzolo means days or weeks, but that time-frame falls under the category of a "flip," not an "investment."

The truth here is every grade of this book, save one, has seen an increase in value of at least 17% (and as high as 118%) in the last 10 years.

Value is a Moving Target

Finally, we have Mr. Zurzolo's advice on how best to determine a comic book's value. He offers up five important trends to look for, culminating in a recommendation of how to best determine a current fair market value.

"To review a book’s current value, check out the latest edition of The Overstreet Comic Book Price Guide, which is regularly updated with new prices and market data. It can also help you understand more about how collectors grade a comic book’s condition and help you avoid getting ripped off."

Not included here is the fact that the Overstreet Price Guide links out to Amazon to purchase the physical copy of the

Earlier in the article, he references the quick rise of Ultimate Fall-Out #4. What do you think the 2021 Overstreet Price Guide lists as its FMV? I bet it's not the same as it is today. The clear problem here is that book will list its FMV the same yesterday, today, and tomorrow. That book is nothing more than an overweight, snapshot-in-time, drink coaster that can't be relied upon mere weeks after publishing.

I think you have to understand this concept to become the COO of a major collectibles house, but "current value" and "price guide published four months ago value" simply don't equate.

May I Suggest...

"Bro, you're being too hard on the guy. He's just trying to normalize the comic book investment market to newcomers!"

Bro, I know. But that's exactly why the information must be tighter and more actionable, or you just end up with - at best - background material about comics, and - at worst - misrepresenting the industry.

For more comprehensive information about getting into comic book investing and collecting from the ground floor, I recommend this article on investing in comics from 2018.

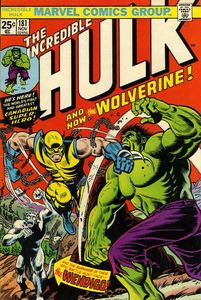

For an analytical look at comics as investments compared to other more common assets, read Brian Colwell's case for owning Hulk #181 over stocks, bonds, and gold.

As mentioned above, a theme of the more modern investment strategy is to diversify beyond the typical monetary assets and look at more unique forms of financial gain. What are you doing with your most valuable books? Holding long-term? Are they part of your retirement plan? Let me know in the comments.