Comic books from fifty-plus years ago are now worth quite a bit of quatloo. Back in 1970, you could buy Amazing Fantasy #15 for a mere $15! Amazing Spider-Man #1 was around the same price. This inflation in value over time is a key aspect of investing in comic books long-term. Of course, inflation isn't the only reason for price appreciation but it makes for an interesting correlation. Inflation was rampant in the 70s and 80s when housing prices went through the roof and so did fuel. Both of which play a huge role in the economy.

Comic books from fifty-plus years ago are now worth quite a bit of quatloo. Back in 1970, you could buy Amazing Fantasy #15 for a mere $15! Amazing Spider-Man #1 was around the same price. This inflation in value over time is a key aspect of investing in comic books long-term. Of course, inflation isn't the only reason for price appreciation but it makes for an interesting correlation. Inflation was rampant in the 70s and 80s when housing prices went through the roof and so did fuel. Both of which play a huge role in the economy.

Comic books are simply part of the collectibles market currently benefiting from inflation. Not every collectible makes money; if you look at antique furniture now, they can't give it away. That part of the collectibles business is declining. The reason is not inflationary, put simply, the demographics do not favor antique furniture according to many dealers losing a great deal of money in that business over the last 20 years.

This all begs the question; is it too late to invest in comics? The answer is that inflation should increase, demographics favor the Silver, Bronze, and most especially the Modern Age of comics. Is it too late for a new collector/investor to get into this vast comic book market? Not by a long shot! There is plenty of time to jump in. There are many series, comics, keys, characters who still haven't gotten their time in the sun. In my opinion, if you stay invested in late 20th Century comic books, the future looks bright. Let's compare and contrast some of these big books today, versus their early prices in the 70s. Could comic books make a great long-term inflation hedge for investor assets?

Inflation and Comics

Inflation and Comics

The problem with inflation is twofold: first, it increases prices across the board (mostly), and second, it decreases the value of the dollar. How to counteract or hedge against this awful trend? If you want to move money forward in time you can't put it in the bank with savings at less than 1%. A savings account can't keep up with normal inflation of 2% let alone potential rampant inflation that might come in the future. So, what to do? Moving assets through time as collectibles is an alternative to gold, and inflation hedged bonds. Given this is a comic book investment blog it should come as no surprise that comics are a great choice as assets to increase in value over time and defend against a decrease in the value of currency.

Inflation as defined by Fidelity:

"Inflation is a broad increase in the prices associated with a constant amount of goods and services and it is typically spoken of as a negative factor (Source: DTS System Inc. -Fidelity)."

Inflations impact on prices:

Inflations impact on prices:

"Inventory and similar assets are typically valued according to either the company's cost of purchasing the asset or the current cost of replacing the asset, whichever is less. This lower of cost or market principle means that in an era of rapidly rising prices, these assets could have a higher value in practice than that which appears on the balance sheet" (Source: DTS System Inc. -Fidelity)

My thesis: Hedging with comic books is a solid long-term bet that inflation will continue. Should prices rise, it will lift all comic book prices accordingly. Anyone owning vintage comic books should do well. A warning here; demographics shifts notwithstanding. You should be able to protect your assets against inflation buying and holding vintage comic books.

"Hedging, for the most part, is a technique not by which you will make money but by which you can reduce potential loss" (Source: Investopedia)

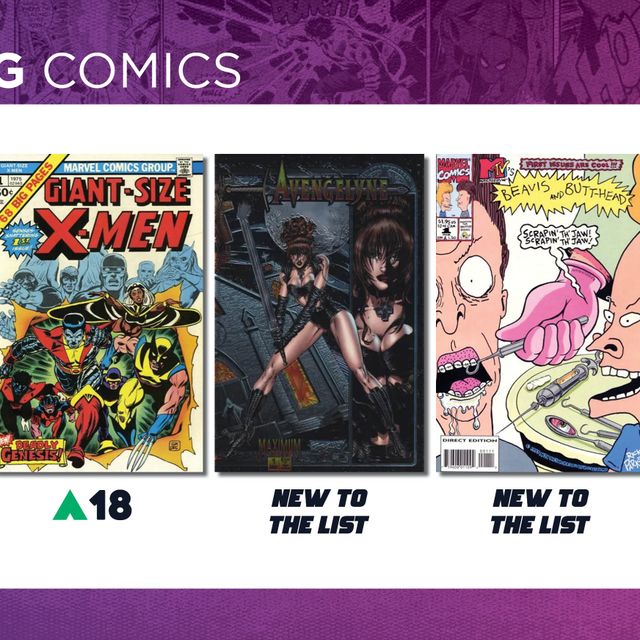

Examples of price increases in comic books over time:

1970 price $300

Recent Price $2,052,000.00

1970 price $14

Recent Price $200,000

1970 price $.15

Recent Price $5,555.00

Year of the Villain Hell Arisen #3

Year of the Villain Hell Arisen #3

2020 February price $4.99

Recent Price $183.00

| Title | Grade | Last Sale | CGC Census | Return |

| Year of the Villain Hell Arisen #3 | 9.8 | $183 | 1604 | +46% |

Conclusion

Conclusion

Obviously, we see a pattern here of rising prices over the long and short-term horizon with comic books. It should be noted these are all keys. Further, they are the biggest keys for their eras except for Year of the Villain and Conan. Are non-key books from 50 years ago worth zip? Not really, even the average back issue comic book about 30-40 years old runs about $10 at your LCS. If that is a Bronze Age non-key it is still worth about 13 times its original cover price.

In summary, taking into account the anecdotal evidence with multiple comic ages, inflation as roughly defined by Fidelity, the concept of hedging your bets, or safeguarding your resources; I will simply state the obvious. Comic books are a good investment in the future; and furthermore a decent hedge against inflation. Finally, comic book investment is a way to move money through time without losing its superpowers: profit and purchasing power.