3 Key Differences

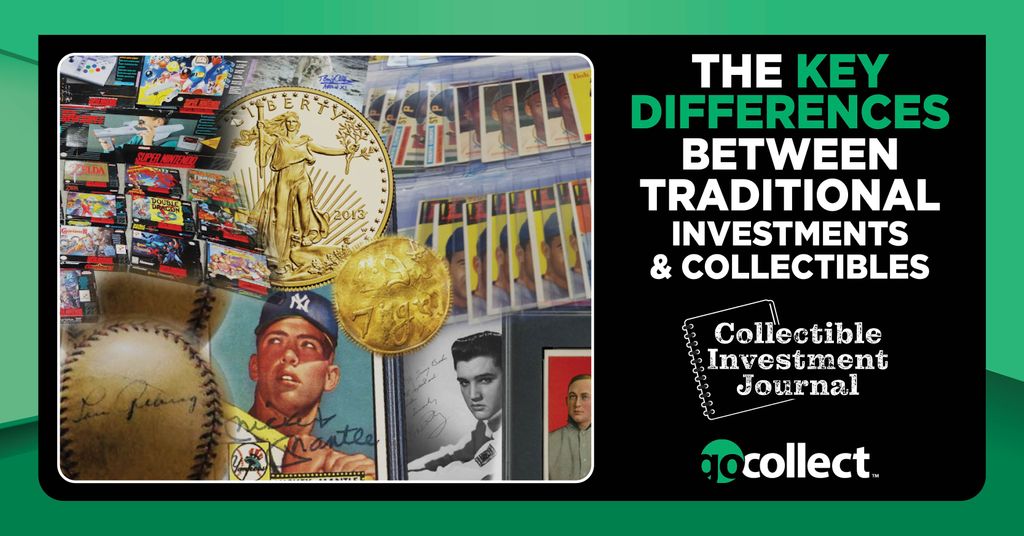

There are three distinct differences between collectibles and their more traditional counterparts when it comes to the investment world.

- Liquidity

- Market

- Valuation

Liquidity of Collectibles

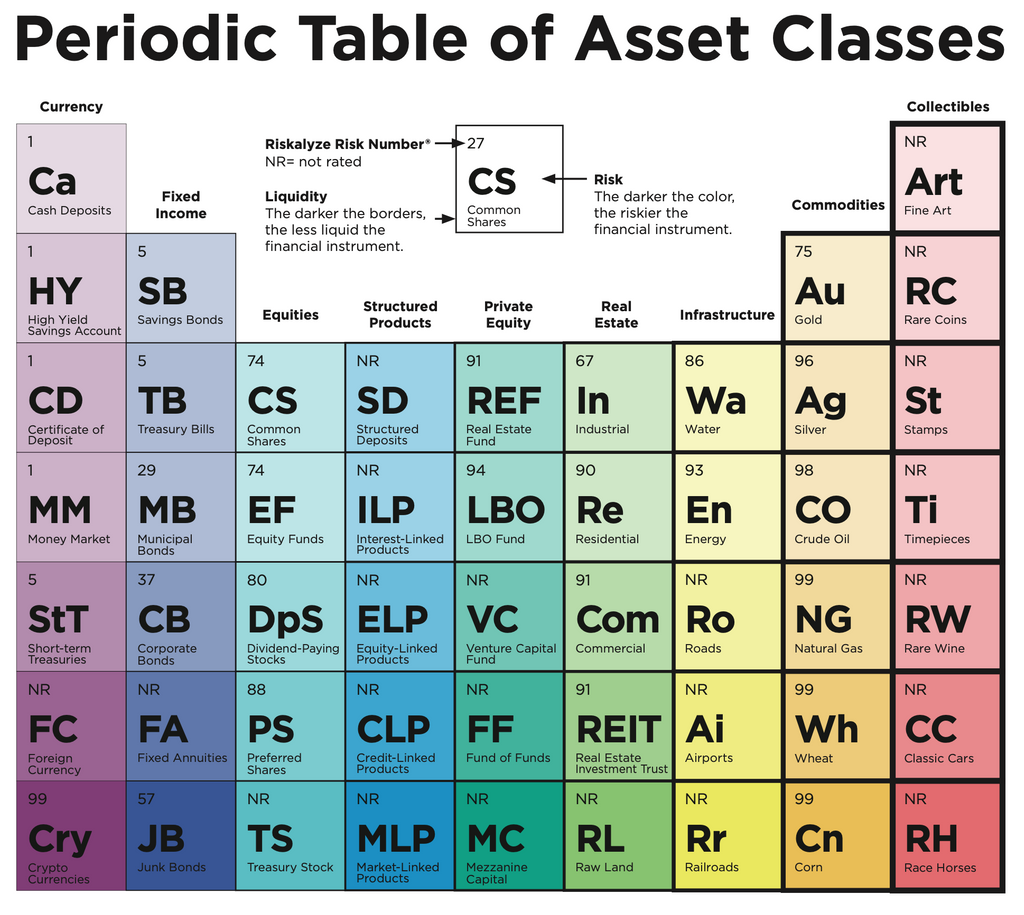

As you can see, on the periodic table of assets, the publisher lists collectibles on the far right of the chart, indicating that they believe collectibles are the most illiquid investment listed. This characteristic is hard to argue as these are tangible assets that you will need to prepare for selling, list to sell, and then complete the transaction.

They are not easily sold relative to a publicly traded stock. This is not, however, a reason to not include them in your overall investment portfolio. On the contrary, the fact that collectibles are less liquid than traditional assets means that they are transacted less frequently which can bring more price stability over the long term.

Collectibles are Not Publicly Traded

While this statement is true, collectibles are not publicly traded, as previously mentioned this can be a positive for collectors as they are not valued on a daily basis. As an example, if your main residence was re-valued on a daily basis, you likely would have sold or bought it ten times over and lost sleep along the way.

The ability to place a collectible in your collection, knowing what you paid for it, and check on the going price for that same or similar collectible on a monthly or quarterly basis, allows you to keep an understanding of the market but also gives you the opportunity to buy and hold for decades without putting your item out to market for sale.

Another positive of not being listed on publicly traded markets is that collectibles are not able to be shorted, or traded with derivatives, which can produce massive swings in price and greatly increase volatility. For day traders, this volatility can yield tremendous gains, but for the average investor, the less volatile an asset, the more peace of mind they enjoy. Merrill Lynch attempted to bring collectibles to the publicly traded markets in the early 90s, but it didn't end well.

According to the NY Times, “Merrill Lynch & Company said that it would pay $20 million to $30 million to settle lawsuits by investors in its ancient-art and rare-coin limited partnerships. Units in the partnerships, which failed, were bought by about 3,500 investors from 1986 to 1990.” The private market for collectibles is attractive for most investors.

Valuation of Collectibles

Collectibles have been a sought-after investment for those with disposable income since the recording of history, the only difference today is the plethora of information and technology that allows us to quantify our collection as part of our overall investment portfolio. However, according to a recent UBS study, 66% of collectors have never discussed their collection with a financial advisor.

There is a lack of specialization in the financial advisor community when it comes to collectibles. Most collectors have an understanding of what their collection is worth whether they have formally had it appraised or simply know the market they have been operating in for decades. The key difference in valuation between traditional assets and collectible assets is the ambiguity that exists within the collectibles market. A collectible could sell for $100,000 in a private sale and sell at auction for $1,000,000 the following year.

Conclusion

For most collectors, a balanced approach to traditional and non-traditional assets is the best of both worlds. They maintain the liquidity of the publicly traded markets while still enjoying the long term growth and stability of the collectibles market while having fun along the way.