Interested in watching the full interview? Check it out here!

Tell me all about Mythic Markets!

"Mythic Markets allows almost anybody to invest in fractional shares of their favorite vintage comics, collectible cards, fantasy art, and video games for as little as $25. It gives people the opportunity to invest in the things that they love."

"First, you log in and create an account. Then, you can participate in, essentially, a mini IPO. You can invest in these shares. Then, after a set period, you are welcome to trade those shares with other people on the platform. Getting started and getting involved is super easy. That's our aim. Particularly in this last year, with the pandemic, when people are hedging against inflation. We've made it possible to invest in small pieces of collectibles."

Then, after a set period, you are welcome to trade those shares with other people on the platform. Getting started and getting involved is super easy. That's our aim. Particularly in this last year, with the pandemic, when people are hedging against inflation. We've made it possible to invest in small pieces of collectibles."

How do you figure out how long it lasts and how to price?

"We get a lot of data from large marketplaces. Also, from GoCollect- we get a lot of our data points there. We use any and all publicly available sources of market data. We don't use private data, however, as that's not verifiable. But we do our best to get as many data points as possible in terms of pricing."

What's on the horizon? Any cool stuff coming up in terms of offerings?

"We've got a Super Mario Brothers 3 that we're looking forward to launching. Also, a Journey into Mystery #83. We have a ton of Magic: the Gathering art that we're excited about too. We have a couple pieces in there that are low-to-mid seven figures. That's pretty exciting to me, as a huge Magic fan. We've got a lot of really cool things coming."

Tell me about the name, Mythic Markets. What makes it truly Mythic?

"For those who aren't from the fandoms, mythic really is about some of the rarest and most sought-after collectibles. It's a way of gauging the rareness and the desirability of those things. We source from a number of different places to bring these grails to our investors. That's the origin of Mythic."

There are a couple of players in this space. It seems to be getting some good attention. What sets your company apart? What's your value play?

"We are really focused on the "geek" fandom experience. We are sort of niched in comics, video games, art, etc. I think there's a lot of value in bringing the fans of this stuff together into a single platform. There's a shared interest. We believe that we have an advantage at creating experiences around these fandoms."

Will you expand into other geekdom categories? As far as I'm concerned, concert posters are the most underpriced and underknown collector asset market out there. And there are a lot- there are lunchboxes, hot wheel cars, etc. How deep will you go?

"I think a lot of it comes down to where the interests are. A lot of what's driving interest right now is how quickly the

For sure. I'm looking at things from an investor angle now. You're a security. Traditionally, securities have cash flows around them. They have a decision team. Can you expand more on that?

"Securitising this is less about the asset generating revenue than making it accessible to anyone who would want to participate in it. To be fair, this stuff can generate revenue. It can be loaned out to a collection or shown, or have tickets sold out to it, for instance. It is more about access."

So really part of the investment is an investment in you and your team to make good decisions along the way about how to monetize the item itself, is that fair to say?

"In some ways. A big part is the curation. Being able to source those super rare things, those things that have the potential to perform as an investment. That's something we spend a lot of time on. It would be less about necessarily generating revenue than unlocking the liquidity of this item that is rapidly increasing in value.

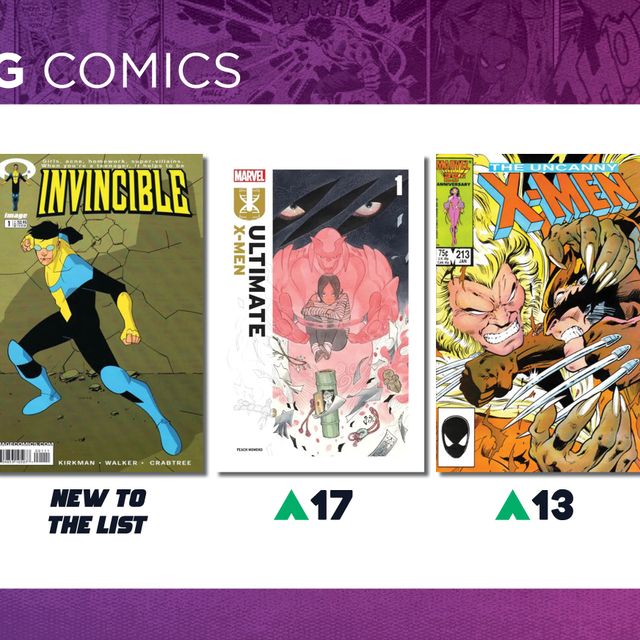

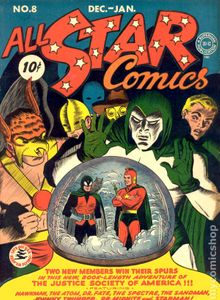

An example would be comic books. Comic book awareness is largely driven by superhero films, new shows, etc. As more people become aware of these heroes and these characters, they want to invest in these things. I think it was All-Star Comics #8, the first Wonder Woman, where, two months after the film came out, a book sold for $930,000. It was less about how that

Jeff: That makes sense. Golden Age Comics are very similar. New collectors with big dollars create frenzies within the auction place and then prices skyrocket. A lot of that is driven by when to buy and when to sell. Who determines that the market is the best time to sell a mature security?

"We take offers and poll the shareholder base to determine whether they want to sell or not. If the offer is accepted by the shareholders, the offer goes to our investment committee to make the ultimate decision."

As someone who tends to buy through retail and sell through the same people I buy through, there's always a collector's dilemma about not paying a fee as a buyer. How do you solve that collector's dilemma? Paying a percentage on the differential?

"There are going to be marketplaces that exist to connect buyers and sellers and there are often fees to do that, just like any kind of market. I think there's always a push to drive down costs, especially at lower levels like individual $10 cards. That's when costs like shipping start to add up. I think there's always going to be some kind of fee, no matter how it's done. The goal is to make it less painful. We don't charge any fees for trading. And we don't charge fees on the disposition of the entire asset, either."

I am wickedly interested and I can't wait to see how things go. Any last thoughts?

"I think it's just a really exciting time for collectibles, in general. There's no better time to get involved. New things are always popping up. I think most people should be wary of sticking to cash and I think there's a reason why these alternative assets have been picking up a lot of interest lately."

Thanks to Joe for talking with us today! Visit Mythic Markets for more information! We'd love to hear about your experience.

What do you think? Is Mythic Markets a company you'd be interested in working with?

Help GoCollect make your collecting dreams a reality. Upgrade to a premium account today!

*This post is sponsored by Mythic Markets