How to Measure Success

My colleague Norman Robinson III wrote a great analysis of the collapse in pricing on Eternals comics, which you can read here on GoCollect. But where he sees bricks, I see a potential foundation.

2021's Eternals has the lowest Tomatometer score of any Marvel Movie: just 47% making it the only Certified Rotten movie in the MCU, but it grossed just over $402 million worldwide and maintains an audience score of 78%. With a production budget of $200 million, and a marketing and advertising deficit of only $15.5 million (with the bulk of promotional expenses covered via $100 million in publicity partnerships with Lexus, Geico, and the L.A. Rams), Eternals was a bonafide hit that had the tough luck of releasing during the pandemic.

What was good for Disney stockholders has not been as good for comic collectors.

At least not yet.

Timing

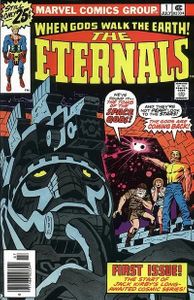

There is a new, "common" wisdom among collectors that advises steering clear of comics that weren't well-received when they first appeared on newsstands –even following the hype of a new movie announcement, but the fact that The Eternals was not a best-seller back in 1976 is anecdotal to its failure as an investment property today. And even categorizing the 80% drop in price of Eternals #1 as a failure assumes that one bought at peak pricing and sold at the bottom of the market.

Savvy collectors bought all those Eternals keys back when the movie was first announced and sold them a week before it opened. Those people made a fortune. If we judge all investments by the folly of Johnny-come-latelys we can find failure in almost every slab.

My advice? Recognize the pattern: Buy on the rumor, sell on the hype.

And if the FMV on a book doesn't warrant paying for Express grading, sell it raw.

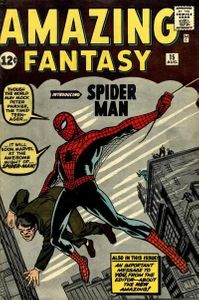

Whether or not you think Eternals is a good movie, the plunge of Eternals-related keys is part of a larger pattern that has seen almost ALL key issues drop significantly in the post-pandemic resale market. Spider-Man: No Way Home was Certified Fresh by critics and garnered a near perfect 98% Audience Score. It earned almost $2 billion at the global box office, but in the six months between opening theatrically and debuting on streaming services, the first appearance of Spider-Man in Amazing Fantasy #15 had gone from setting the record as the most expensive comic book ever sold (a 9.6 for $3.6 million) to one of the most steeply declining comics across most grades.

Much of the reasoning behind the crashing value of AF15 is that hundreds of copies of lower grades flooded the market after the record-setting sale, and hundreds more were submitted for grading in late 2021. Some are just now getting back to their owners and they continue to hit the market. What is inarguably the most important single issue of the Silver Age is a much more common commodity than it used to be.

Similarly, thousands of Eternals comics were backlogged in the grading queue and not returned until after the film had been released to the luke-warm reception that begat the currently perceived "superhero fatigue." It is possible that there are still hundreds if not thousands of them awaiting return, but if the current census report is indicative of what will soon be re-entering the market, the abundance of the premiere issue may have created a false impression of availability of the subsequent issues, and that leaves potential for some of them to catch a bounce.

Crazy Rich Asians

From 2020 to 2021, there was a massive boom fueled by stimulus checks and market conditions that saw comics double and triple in value. And now in 2022 at the head of a recession we are seeing comics drop on average by 50%. This could be viewed as a market correction and not a crash, but the steeper the decline the better prospect for values to bounce back quickly.

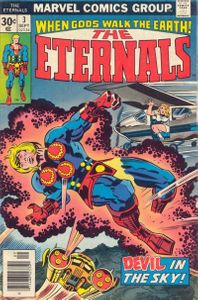

Interestingly, Eternals #3, the first appearance of Sersi has only experienced a 30% drop from last year's peak pricing. There are a total of 2444 copies on the census across all grades, making it rarer than Amazing Fantasy #15 by more than a third.

Gemma Chan, of Crazy Rich Asians fame has signed a multi-film contract with Marvel Studios. We know that several other actors from Eternals have inked similar deals, so by the time we get to a Black Knight movie, Sersi may have appeared in numerous MCU projects. Hopefully, she'll be back in the spotlight and given more to do.

I have to imagine the MCU has bigger plans for Kumail Nanjiani, as well. Kumail is a fan favorite who kickstarted his career by hosting a live comedy show in the back of Meltdown Comics in Hollywood. His weekly comedy show picked up traction which led to a Nerdist Podcast and ultimately a series on Comedy Central. As an actor he has been scene-stealing his way to leading man status for about a decade. Big Sick, the autobiographical romantic comedy written with his wife, Emily V. Gordon, garnered an Oscar nomination for Best Original Screenplay and cemented his status as a versatile talent with broad appeal. Indeed, one of the criticisms of Chloe Zhang's film was that Nanjiani is absent from the coda.

It is worth mentioning that the best MCU films have been helmed by comedy writers. And the most timeless films of any genre have a poignant blend of comedy with the action or drama. If the next Eternals film follows the template of Guardians of the Galaxy (the MCU's original who-are-these-guys) by keeping a brisk pace with good laughs that are anchored with a lot of heart, Kingo could be a real asset.

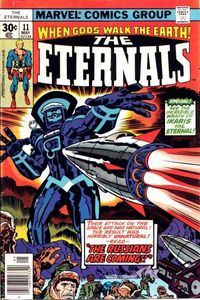

As luck would have it, Patton Oswalt (on the Today Show) revealed that a second Eternals film was already in the works right as I was sitting down to write this. A Kingo solo film or Disney+ series with the right creative team could greatly benefit from low expectations to become a massive hit –think Loki, but Bollywood. Eternals #11 is not just the first appearance of Kingo, it's also the first appearance of Druid, and I can't envision Kevin Feige failing to capitalize on having Barry Keoghan under contract.

Considering that there are only 908 copies across all grades on the census, it should come as no surprise that this is actually rising in price. The current FMV is about 10% above the 1-year average.

Conclusion

A wise man once said, "Never confuse the product for the stock," and I think it helps to think in those terms regardless of the investment. While MCU Phase Four has thus far been a bit of a hot mess, when all the seemingly stand-alone projects are revealed to be connected by things we don't know yet, many a forgotten key could spike in value.

There is no better time to buy than at the bottom of the market, and I can't imagine we get to Galactus without some Eternals being involved.

Want more MCU spec?

-

WHAT CAN WE LEARN FROM THE COLLAPSE OF THE ETERNALS COMICS?

-

TRENDING COMICS: SECRET KANG WARS

-

THERE’S STILL TIME TO INVEST IN: GALACTUS & SILVER SURFER

This blog is written by freelance blogger Matt Kennedy: Matt Kennedy is owner of Gallery 30 South and author of Pop Sequentialism: The Art of Comics. The first comic he bought on the newsstand was Werewolf by Night #32 which he somehow managed to keep in good enough condition to get it graded 9.0 forty years later. Please follow him @popsequentialism on Instagram & Twitter and visit his website: www.popsequentialism.com