Investing in comics you are essentially buying collectibles. No, collectibles do not always go up in value; take a look at antique furniture. Go back 30 years to the 90s and you were paying top dollar for quality wood craftsmanship, as well as, the history of a piece. Nowadays, prices have dropped in some areas as much as negative -80% over the last two decades. What is the difference between these two aspects of investing in collectibles? Also, have comic profits soared and antique furniture just collected dust? Why does one fail miserably and the other succeed?

Diversity in Investments

Diversity in Investments

The top collectibles are the tried and true stuff: antique furniture, comic books, coins, trading cards, sports memorabilia, toys, and fine art. I dabble in all of the above but primarily focus on comic books, obviously. Life is funny, everything can be going great then suddenly the floor falls out from under you. Diversification in collectibles is a good safe bet, no not all of the collectibles will pay off. But enough will that it provides a cushion. In addition, to a diversified alternative portfolio, it also allows you to move money through time without the harmful effect of inflation.

Antique Furniture: A Cautionary Tale

Antique Furniture: A Cautionary Tale

Experts generally define "antiques as items of value that are at least 100 years old and less than 50 percent restored." They often cite the 1930 Smoot-Hawley Tariff Act, which set the "100-year benchmark for antiques in the United States and also established 1830 as the approximate beginning of mass production in the U.S."

DEMOGRAPHIC SHIFT

DEMOGRAPHIC SHIFT

"Antique lovers can’t blame the economy, " per Grove (Antique Appraiser). The culprit is “a worldwide demographic shift.”

(The source above: Dayton Daily News by Jim Dillon)

What does all this mean? Investing in comics can swing up or down. This proves that not all collectibles are valuable or go up in value in perpetuity. Since we are driving through the wasteland of antique furniture I thought it might be fun to compare a few different "alternative collectibles."

| Type | Name | Sale Price |

Returns * Percentage estimates only! |

|

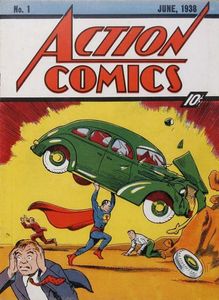

| Comic Books | Action Comics #1 | $3.21 Million (eBay) sale per GoCollect.com grade 5.5 $956000 | +691.7% (13 year return 5.5 grade) | |

| Coins | Dime-Barber 1894-S | $2 Million (Heritage) | +200,000% (since 1894) | |

| Toys | G.I. Joe 1963 | $200,000 (CBS News) | +10,000% (since 1963) | |

| Trading Cards | Ty Cobb Baseball Card | Ty Cobb Baseball Card sold last year $154,000 (Post) also the Honus Wagner 1909 baseball card sold for $3.12 million 2016 prior Wayne Gretzky purchased that card for $451,000 | +600% (since 1909) | |

| Antique Furniture |

Antique Chest with brass hardware

|

An antique Chest with brass hardware sold for $2500 in 1988 today about $650 loss of 74%. | -74% (last 30 years) | |

| Fine Art | 800 best-known painters in the world holding period of 20 years 6.70% on average,. (Source: Journal of Economic Perspectives Fall 1999 Burton and Jacobsen) | $106.5 Million Actual (Picasso's Nude, Green Leaves, and Bust painting) When this canvas last changed hands it sold in 1951 for $19,800 | Picasso increased in value +5378% rough estimate. |

Conclusion

Conclusion

Any investor will try to diversify for several reasons: inflation, security, even simply attempting to not put all your eggs in one basket. From a comic book collector and investor perspective. This translates to not having everything in one comic book, or even perhaps one comic book age. Diversify! Diversify! And then... Diversify!

Remember kiddies, keep your arms and legs inside the ride at all times. Investing in comics can be a wild ride. Don't grab any fly by night deals, don't consolidate in one type of comic, and most especially diversify. If you happen to get drenched by the log drop and a demographic shift; well at least you will have already diversified your portfolio of alternative investments. If these investments are too volatile, then you can always head over to the Tea-Cup ride, which is safe and boring a.k.a. the U.S. Treasury bond.