The trend has probably hit you in the pocketbook already. And, if you're like me, it's priced you out of a number of desirable comics you wanted to get your hands on. I once had hope of landing a mid-grade Fantastic Four #1 for my

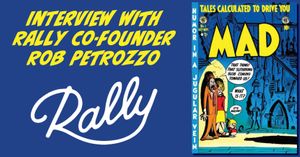

In the absence of collectors and investors being able to pull off complete purchases at this level, companies offering a share of these high-end collectibles have started to also take off in this space. The first of its kind, Rally is now one of only a handful of platforms offering fractional ownership of some of the most sought-after pieces in the world of collectibles. Including comics and video games.

In our conversation, we were able to get into what exactly is fractional ownership, their strategy for comics specifically, and what the future of this hobby looks like.

Rob Petrozzo - Rally Co-Founder and Chief Product Officer

As Chief Product Officer and Co-Founder, Rob's role seems to consist of a little bit of everything. But the real job description is to define the strategy, design, and experience of the Rally app for their users. This includes everything from the way the app looks & feels, the categories they launch, and the communication with users.

With his two longtime friends and co-founders, Chris and Max, Rally started in 2016. It's based on the idea that there are a lot of missed opportunities in the collectibles that they knew best and cared the most about, but they couldn't even think of buying anymore. Five years later, Rally has run over 300 offerings and expanded into over a dozen individual collectible categories along with opening a retail museum in New York City with plans to launch a dozen more asset

What I learned in our back and forth is not only Rob a great guy to work with, but he really knows his comics and collectibles. Here's our conversation:

Rally and Fractional Ownership

Can you explain Rally's business model? What does it mean to have fractional ownership in a comic or a piece of memorabilia?

So the short answer- Rally is a platform for buying & selling equity in high-value assets with historical or cultural significance. Every week we run Initial Offerings. This allows investors to purchase shares of assets. It's similar to the way they would buy a share of a stock in an IPO. We also facilitate a secondary market for those assets through registered broker-dealers within the app to exit your position or add more along the way. To us, investing in a book or a card on Rally is a way for everyone to get meaningful access to the things they really care about, without just investing in a ticker symbol.

It can be your equity in a collectible instead of physical possession, or it can be partial ownership in the museum-quality, often highest graded example of an item as a compliment to your physical collection. We built this as collectors, to access the best-in-class items that have become unattainable for us and for many collectors over the past decade.

What have you noticed about the appetite for this type of investing? As the value of many collectibles has skyrocketed in the past year, have you seen more of an audience for this type of ownership?

Passion is an emotion that really levels the playing field for a lot of collectors and investors. I think that idea of investing your time and your money in the things you truly care about became very prevalent over the last year. Prices moved with that newfound, and often nostalgic, rediscovered passion. The new generation of collectors connects with their childhood; with the names and brands that have remained relevant in their lives. I think that led a lot of people to Rally throughout the pandemic as they reconnected with those assets.

Comic books are the perfect mix. Its childhood, it’s the huge entertainment universes which are as relevant today as ever. It’s an investment that is much more interesting to this new class of investor than a 401k or a random ticker symbol. There's real history and a real connection and, in many cases significant returns over decades. It appeals to everyone one way or another, and on Rally you get to make that investment with a group of people who share those same interests and that same passion.

The Collectibles Market

How does Rally come to own or possess the items available for ownership? What type of experts or procedures are used to authenticate an item or make a go/no-go decision on acquiring something?

We have an in-house acquisition team that uses a data-driven method to evaluate thousands of assets a week. They look at things like historical appreciation, rarity, provenance, air-tight authenticity, and all the tangibles. But we also track social and cultural relevance just as closely. We make sure an asset is important in the bigger picture. We want to ensure that any item we release on Rally is relevant now, and will be relevant in the future. That’s always part of the determining factors when we list an item on Rally.

As for the actual acquisition, we have deals coming to us on a very regular basis. But when we need to find a special item that meets all of those criteria, we work with our network of experts with whom we've developed long-standing relationships and well-known collectors who present us with deals that meet those strict acquisition standards. This allows us to source the best items from a variety of people, collections, and institutions without ever sacrificing quality, either through purchase, consignment, or securitizing a portion of the asset while the original owner can maintain a portion of the equity and invest alongside the crowd on Rally.

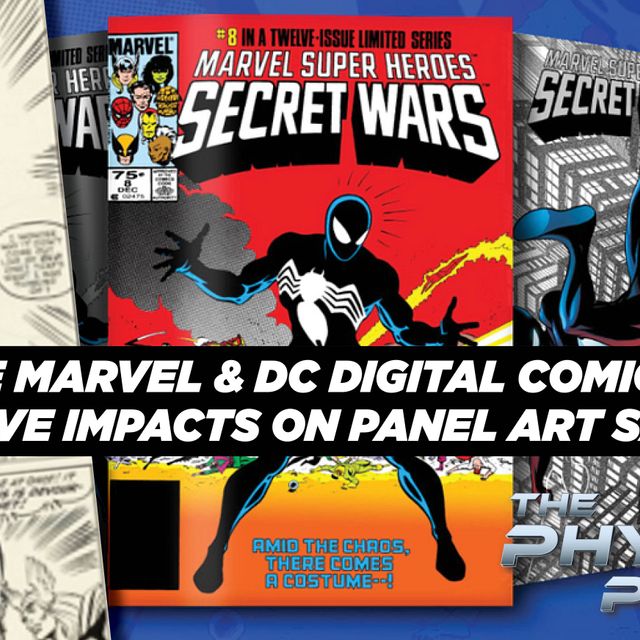

Rally's Comic Book Strategy

For comics specifically, where they always a part of Rally's offering? Or have they been a later addition, considering their attractiveness as investment pieces lately?

When we started Rally in 2016, we knew the entire platform would be driven by the stories of these assets. We started by putting all the things we cared about on paper; basically dumping out our entire childhood and all the aspirational names and products we wanted as kids into one document. Names like Michael Jordan, Porsche, Harry Potter, and a

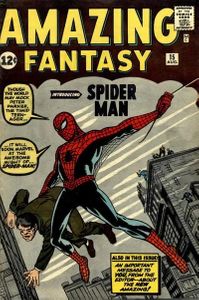

You back into the most important names in entertainment and the ongoing multigenerational nostalgia of a character like Spiderman, for example, and match that up to the returns on high-grade copies of Amazing Fantasy #15, then factor in the story behind the book and Stan Lee’s history, and the fact that the franchise has become one of the most valuable in the world 60 years later, and you start to realize how important these books really are in the universe of collecting. That type of story is true for so many of the books on Rally. It's one of the reasons we knew from the very beginning that it was an asset class we needed to showcase in the app.

What do you think your customers find attractive about owning a piece of an ultra-high grade of X-Men #1, for example, as opposed to saving and scrounging to own my own lower-grade copy sometime in the future?

The beauty of the platform is that you can do both, and we’ve seen that a lot from our investors. X-Men #1 is a perfect example. Any grade over 8.5 simply does not come to market. You are talking about a handful in existence, the majority of which are in private hands and rarely trade. If a 9.4 went to auction today, you’re potentially talking 7 figures. It’s a grail piece, and that’s what we specialize in.

Rally has quite a diverse mix of Marvel, DC, heroes, villains, etc. in its collection. Are there future plans to acquire any more comics? Is the company on the lookout for anything in particular?

We’re always looking for the rarest examples, first appearances, and the most important moments in each franchise. There are some boxes we haven’t checked yet, as we’re still on the hunt for the right examples. Action Comics #1 is obviously one of them. We’ve also started thinking more about original art and the origins of many of these characters as items for Rally. So many of these stories and characters have transformed over time. To be able to bring the earliest examples and the ideas that sparked the stories to Rally is important to us.

There are also some more esoteric books that our average investor might not know about. They really set the table for the space that is interesting. New Fun Comics No.1, what I would consider the first true original narrative comic book and basically the origins of DC, or Funnies on Parade which is technically the first modern comic book, aren’t going to

The Future of Rally

What does the future look like for Rally? How does it grow and expand in the short- to medium-term?

For us, the product goal is always to build more liquidity and more on-ramps for new investors and existing collectors. That's the everyday future. In the bigger picture, many of our users have been studying these assets. They were collecting within these categories long before we gave them the ability to add them to a portfolio. Our goal is to provide them with the access to complement that passion and that knowledge, in all collectible categories.

If an asset class has a group of people who care about it, that’s a space we want to be in and a space we will be in, whether tangible or intangible. Collectibles as a whole have gotten a lot more attention over the last 18 months. Prices will go up and go down in the short term. Still, we believe the interest in the space from this new class of investors is here to stay. Our goal is to support and build for that community every day.

What do you make of the Non-Fungible Token (NFT) craze of the last six months? Is that a collectible market that is here to stay and is there a place for comics in it?

As a creative, I think it's a super interesting time. You have the convergence of a lot of different factors coming together to turn digital art into an alternative asset. From an artist's standpoint, you can put a value on the work and let the community determine whether or not that value is accurate. It's going to be really interesting for things like sports cards and superhero franchises in particular. Now you have a young, knowledgeable, tech-enabled collector who already understands how crypto markets work. The Marvels of the world have a huge opportunity to follow Gen Z into this new digital space, connect NFTs to experiences, and create an entirely new form of collectible within a universally recognized brand.

Do you have a personal favorite genre of collectibles? What are some of the "grail" pieces you would own if you could?

My favorites are kind of everything. I grew up in the early 90s, so video games, cards, and comics were a part of everyday life. So many of those characters are still relevant today. Some of the earliest Mario Bros. and TMNT pieces are still at the top of my grail list. But prices have moved dramatically and available supply is drying up.

I’ve also been looking more at art and illustration. MAD magazines were a big part of my childhood; one of my dream jobs as a kid was to be an illustrator for MAD. I have a couple #1’s in my personal collection. Still, I’d love to find a 9.6 grade that doesn’t entirely break the bank. Early Disney or Stan Lee and Jack Kirby sketchbooks with notes back and forth to each other are something I’ve been looking for for a while as well. Sheets pop up every now and then, but I’m looking for something special.

_____________

Thanks to Rob Petrozzo for a great interview! What do you think of Rally and the fractional ownership phenomenon? Are you invested? Still on the fence? Let me know your thoughts in the comments!

[Disclaimer: The author of this piece is invested in several assets on the Rally platform]