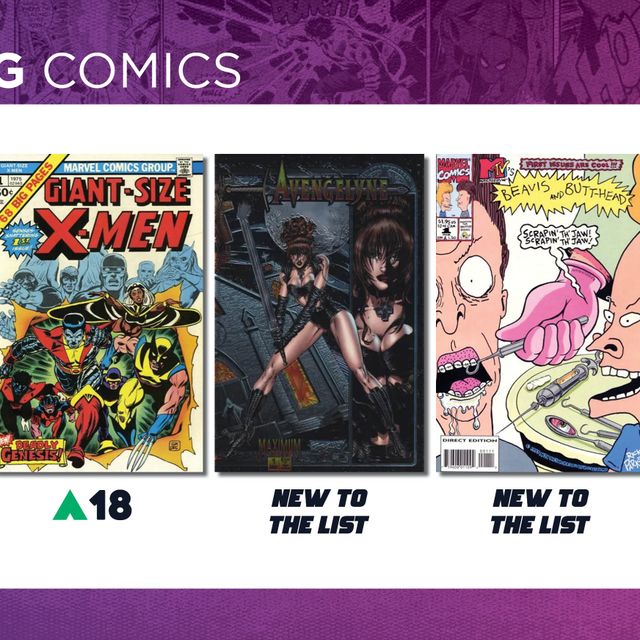

The tax treatment of collectibles is different from other investments like stocks and bonds. The IRS considers collectibles to be "capital assets," which means they are subject to capital gains tax when sold at a profit. The tax rate for collectibles is typically higher than for other types of investments, such as stocks and bonds, due to the fact that they are considered "collectibles" and not "securities."

The capital gains max tax rate for collectibles is currently 28%, which is higher than the maximum rate of 20% for long-term capital gains on other assets. However, it's worth noting that this rate only applies to items held for more than one year, anything held for less than one year could be subject to ordinary income tax.

If you hold an item for more than one year before selling it, the long-term capital gains tax rate applies, which can be as low as 0% for those in lower income tax brackets and up to 28% for those in the highest tax bracket.

Keeping Track

It's important to keep accurate records of your collectibles transactions in order to properly calculate your gains or losses for tax purposes. This includes;

- keeping track of the purchase price, any expenses related to acquiring or selling the item (such as shipping or auction fees), and the sale price.

- If you sell multiple items during the year, you'll need to report each transaction separately on your tax return.

- Maintaining an up-to-date inventory list, if possible, can make your life easier.

If you're a serious collector who buys and sells collectibles on a regular basis, it's worth consulting with a tax professional to ensure you're meeting all your tax obligations. A tax professional can help you understand the specific tax rules that apply to your situation and can provide guidance on how to minimize your tax liability.

It's also worth noting...

If you donate a collectible to a qualified charity, you may be eligible for a tax deduction equal to the fair market value of the item at the time of the donation. This can be a useful strategy for collectors who are looking to offset the tax liability of selling a collectible that has appreciated significantly in value. This can be a win/win scenario for collectors.

It’s important to work with a tax professional in order to ensure that you are paying and/or receiving the correct amount of taxation. Gains in the collectibles market are subject to capital gains tax, which is currently higher than the tax rate for other types of investments.

It's important to keep accurate records of your transactions and consult with a tax professional if you're a serious collector. With proper planning and record keeping, you can minimize your tax liability and ensure that your collectibles investment remains a profitable and enjoyable hobby.