I. Net Profit for Comic Book Investment

The first mistake I observe by many investors is failure to use the most basic comic book investing formula. I observe this mistake many times at live auctions. Sadly this behavior is also observed at casinos.

Hypothetical Example (Only the names have been changed)

Comic book investor Peter Parker won an eBay auction on 9/30/19. The book he purchased was Silver Surfer #3 for $700. He uses his aunt's computer on July 25, 2021, and sees an FMV of $2,400. He had a Parker sense that this book was going to produce. Now his whole body is tingling because he "made" a profit of $1,700!

The Net Profit Formula

Peter Parker is guilty of the classic rookie comic book investor mistake. A book may see an increase in the FMV, but until you sell the book you have made nothing! The reason for that is because you have not realized any money from a sale. Only when Peter sells his book he will have the data to determine if he made a profit.

The most basic comic book investing formula requires a sale because of all the other data that will result from that sale. In simple terms, selling a comic book involves costs. These costs may include but are not limited to auction fees, shipping costs, grading fees, storage costs, insurance costs paid on the book, and state and/or federal taxes. These values will enable you to use the most basic comic book investing formula:

Net Profits= Final Sales Price - (Purchase Price + Total Ancillary Sales Expenses)

Many collectors think they have made a profit on a sale, only to realize after all the costs have been added that they had, in fact, suffered a loss. By then it is too late. You can observe this mistake with many short-term speculative sales books. The key to avoiding this pitfall is to understand what your total costs will be if you sell a book. Knowing these figures like the back of your hand will take the guesswork out of selling your books. Possessing this knowledge will aid you in determining what your sales target must be for your to turn a good profit on a book.

II. Return on Investment

Another mistake comic book investors make is the way one quantifies a successful investment. The belief that the net total you make on an investment defines your success may be an imperfect methodology to evaluate your successes. That is only part of the equation.

Hypothetical Example Comparison (Only the names have been changed)

Two comic book investors got into a nasty fight over who was the best at what they do. Victor Creed says that he is the top cat in comic book investing. He says he can prove it because he bought a 9.4 Inhuman #5 on 2/3/20 for $34 and sold it on 7/17/21 for $239.99. James Howlett thinks he is the best at what he does, and what he does is high-end comic book investing. He purchased an 8.5 Giant-Size X-Men #1 on 3/2/21 for $7,000 and sold it on 5/1/21 for $8,700. They both say that they are the better comic book investor. Who do you think is the winner? The answer is easy but these two would rather fight, so it is up to us to do the proper calculations.

Return on Investment Formula

One of the most common mistakes investors make is the assumption that the more money you receive from the sale of your investment, the better it was. The problem is that this is a defective and imprecise way to evaluate the success of an investment. Remember, not all investors have the same amount of money to invest.

A better means to evaluate an investor's success is to review the Return on Investment. There are a few different versions of the formula you can utilize, but the most simple one is:

The final value is a percentage that we can use to compare to different investments, so you must remember to multiply your figure by 100 to get a percentage. In our example, I am going to PRETEND that there were no actual costs associated with the sales of the books. I know I had just said that the sale of books involves costs in the previous section, but for this example I want you to be able to follow the GoCollect data on your own.

Reviewing the Data:

Victor's formula would be 239.99-34/34x 100= 606% James' formula would be 8700-7000/7000x 100= 24%

James made more money, but Victor chose the better investment. The reason is that the total dollars earned is not the only factor used to evaluate success. The key is that you want more bang for every dollar invested. Think of all the money Victor might have had if his ROI was 606% and he had James' initial $7,000 to invest. Most financial planners say a good ROI is 10%. Both of our fighters exceeded that amount, but Victor was well beyond James on his return percentage so he is the winner of round #1,256,609 of their fights.

III. Advance ROI (Time Variable)

If you really want to get tricky you can review your ROI and factor in time as a variable. For example, this will allow you to compare investments that you may have sold after owning for one year with another you owned for twenty-five years to determine which one was the better choice. You can actually compare investments you sell that you owned for any number of years. The formula is:

Annualized ROI = {[1 + (Net Profit / Cost of Investment)] (1/n) – 1} x 100

N is the number of years you owned the investment in this formula. This is, again, more advanced and I advise you to start simple and work your way up.

This is the formula I would recommend for individuals with older collections and higher-value books. I have seen many a collector who is not sure how to begin liquidating a collection that they have had for decades.

This is the formula I would recommend for individuals with older collections and higher-value books. I have seen many a collector who is not sure how to begin liquidating a collection that they have had for decades.

This is the perfect way to start. You would have to estimate the costs, but if there is an annualized ROI you have as a target you can then plug in those estimates, the original purchase price, and the time you owned the book to give you the minimum sales price for your book. I bet you thought your days of solving for a variable were over.

IV. GoCollect Tricks

Once you understand the science and formulas of comic book investing you need to use the formulas to your advantage. There are many ways to use these formulas. I will discuss three ways I alter the formulas slightly to give me some new insight into my books. All of these require me to use the GoCollect recent sales of the books to create a hypothetical ROI for the book I am reviewing. Sometimes I use the averages and sometimes I use only one sale based upon the method of that sale and how I would plan on selling my book. Using the modeler, you can see hypothetical sales data to inform you.

Diversification

Customizable Modeler - GoCollect

Customizable Modeler - GoCollectOne of the benefits of plugging the GoCollect data and cost estimates into hypothetical sales using the modeler is to create virtual transactions for diversification evaluation. Everyone knows you always want to diversify your investment to minimize risk. Everyone's risk tolerance is different. Using the GoCollect data can help you create models to review your investment plan to determine if your investment is not diversified enough.

In addition, you can review potential sales of books you own with other books you considered within your tolerance limits that you wanted to buy to determine if you made the right choice. This may help you to decide if you want to keep investing following your initial plan or diversify into one or several different books with varying risk tolerance levels that may have produced better ROI during the same time frame.

"HOT" Internet Tips

Not all sites use data to predict what books may be hot. They may have heard it from a guy who heard it from the guy who had a friend who ... Risky "hunch" speculative picks should be evaluated using the ROI formula repeatedly in very short time intervals. I may do this every month or maybe even every two weeks.

Holding on to many different risky speculative picks for the long term may not be wise if you see that most of your choices are not producing. Too much red ink is not a good sign in financial investments. Finally, studying other books will allow you to see if there is another speculative book to get into if your book's "potential" ROI is too low for that risk.

Long term ROI Checkup

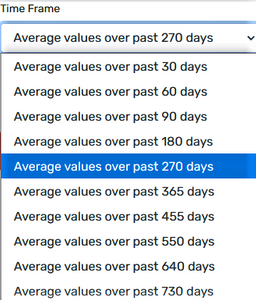

Values over selectable time periods - GoCollect

Values over selectable time periods - GoCollectThe data is at your fingertips, so use it. Every year you can review your book's initial sales price with the yearly average of the sales prices for that book to see a hypothetical ROI for your own books. I love looking at the trend values provided by GoCollect every month to see how my books are performing, but for a more personal analysis I use my own purchase prices to get a hypothetical ROI.

This allows me to track my books and lets me see what books I may want to keep and what books I may want to liquidate on a yearly basis.

This trick is very important for books like Golden Age and low print run Variant books. These books may rarely come up at auctions. If you want to evaluate an ROI for a possible sale then this type of analysis may help you avoid making an improper decision. Instead of using recent sales data, you may be forced to use the GoCollect calculated FMV. This trick has helped me decide many times decide not to sell a book that at a later date would reveal a very high actual sale. The tools are there. All you have to do is use them.

VI. Conclusion and Parting Notes

Investing in comic books is more than reading the "hot" lists online. Luck is a small part of it. People also say intuition plays a part, but does it come from a mystical force or something more concrete? I believe in science and data. In my opinion, you must study the numbers as a scientist would to assist you in determining the proper investment course for yourself.

In the end, the decisions are up to each individual investor. I like to see certain books have an ROI of at least 20%. Some books, though, I will keep with a lower ROI yearly estimate if I can see low CGC census numbers or very few books with a higher grade than my own copy.

Your risk tolerance and ROI expectations will differ from others. This variance is acceptable because your decisions will be based upon your review of the facts.

As always, there is no sure thing when it comes to any investment. The most you can do is put in the time and effort to take some of the guessing out of your decisions. If not, I hope your name is Kang the Conqueror and you have access to time travel.