We all know the drill. A movie is announced and IMMEDIATELY speculation on who might appear in that movie ramps up, along with sales of those characters' keys. But is investing in comic book movie characters always the safest bet? Let's take a look.

1.Goal

The goal of this analysis was to review the short and long term investment potential of non-major comic book characters that were to appear in films. I utilized the grade of 9.2 so as to not introduce the "highest grade" premium bias into my review. Silver and Golden Age books were not selected to again better reveal movie appearance impacts on books. Higher grade books in these ages sell for a premium and could impact the numbers.

I selected characters that could be considered non-major by hobbyists. Three of the four were female characters in comics and were greatly ignored previously by collectors and investors. Analyzing these characters may thus reveal a movie bump because of these books not drawing great interest in the past before their inclusion in a movie was announced. Finally, I decided to select movies released at different times to try to see if the pandemic skewed the numbers.

Books Selected

DCEU Characters

DCEU Characters

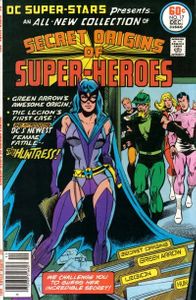

Bronze Age Hero- DC Super-Stars #17 (1st Huntress*). All-Star Comics #69 came out the same day but has a smaller CGC Census, so not selected.

Modern Age Villain- Wonder Woman #7 (1st of Barbara Ann Minerva later to become Modern Age Cheetah).

MCU Characters

Bronze Age Hero- Ms. Marvel #1 (1st Ms. Marvel). The first appearance of Carol Danvers was not chosen because of previously mentioned criteria.

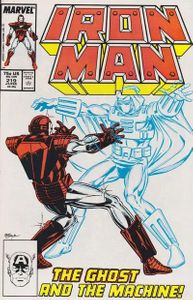

Modern Age Villain- Iron Man #219 (1st Ghost). A Male character in comics but female in the MCU.

I. Last sale for 9.2 after the character was mentioned for film (approx. dates used)

DC Super-Stars #17. Huntress Announced for Birds of Prey 7/16/18. May 28, 2018, fixed sale on eBay for $139.99.

Wonder Woman #7. Cheetah announced for WW84 2/28/18. November 9, 2017, eBay auction with one bid for $25.00.

Ms. Marvel #1. Captain Marvel announced 10/28/14. October 12, 2014 eBay auction for $160.50.

Iron Man #219. Ghost announced for Ant-Man and the Wasp. July 22, 2017. NO SALES FROM 1/1/00 TO 7/21/17

Instant Analysis

Books that featured heroes seem to sell for higher prices. These books have more sales over greater time frames. Villains seem to draw less of an interest.

II. Average sale price for 9.2 and market trends 3 months before and after film release

II. Average sale price for 9.2 and market trends 3 months before and after film release

DC Super-Stars #17 (11/7/19-5/7/20) One sale for $140.00. 9.8, and 8.5 and below grades saw an average trend up of roughly 74%.

Wonder Woman #7 (9/25/20-3/25/21). NO 9.2 SALES. 58 TOTAL SALES. Three of the four grades trend down an average of -25.2%.

Ms. Marvel #1 (12/8/18-6/8/19). The average sale of a 9.2 copy was $223.25. A -30.2% downward trend was observed for the grade. This issue had over 70+ sales and was the biggest mover in the volume of the books selected

Iron Man #219 (4/6/18-10/6/18). The average sale of a 9.2 copy was $86.90 (3 sales). A -66.4% downward trend with one very low sale was observed. That one sale could be either an abnormality or a price adjustment because of the low sales of this book.

Instant Analysis

Those books that one thought would see a bounce from films saw little to no increase in value. The pandemic probably affected some characters like the Huntress and Cheetah. Previously, I observed that the first appearance of Carol Danvers exploded in value among Silver Age collectors. As a result of that price increase, I assumed her first appearance as Ms. Marvel would see the same rise in value. Yes, the book rose in value, but not to the degree I thought it would.

The Ghost received a bump, but from a non-existent market before the film announcement. The large downward trend is scary. In regards to the Cheetah, it was hard to evaluate using the data, but could the poor reception of WW84 have impacted the interest in the character? The way a film was received by fans was never a major factor before, but things may have changed with this movie.

III. Average of last three 9.2 sales and market trends (to 7/16/21)

III. Average of last three 9.2 sales and market trends (to 7/16/21)

DC Super Stars #17. The average of the last three sales was $196.33. The trend from the last date checked is +46.1%.

Wonder Woman #7. NO SALES. A total of 17 sales.

Ms. Marvel #1. The average of the last three sales was $224.65. The trend from the last date checked to current is +53%.

Iron Man #219. The average of the last three sales was $56.58. The book was trending at +43.3%.

Instant Analysis

The trend for Ms. Marvel looks great from the last date checked to 7/16/21. The problem is that the last three sales were all trending downwards. DC Super-Stars saw a nice increase in value since last checked. The Ghost came from nowhere to have some value, but is nearing three years with a total of 13 sales in this condition for less than the price you get around the release of the movie. The total lack of Wonder Woman #7 sales when there should be more interest is troubling. This book was on the hot list for several weeks and yet now there is very little interest in the book in the 9.2 grade.

Analysis

Movie news is one of the biggest drivers in comic book sales. Numerous articles are published about how to profit from these movies. The problem is that this may be a classic example of FOMO. The news drives the hype and sales volumes. These books do rise in value, but not to the degree of the hype. These books may be good investments but there may be even better investments out there that you are ignoring.

Another area that I am now concerned about is other "key issues" for these characters. The books evaluated were all first appearances of the characters involved in the films. There are no bigger key issues for these characters. If these books are seeing good returns, how solid an investment are books that are ancillary to these first appearances? Numerous investors purchase these books, but could the time frame profit windows be even smaller with these less-key books? I believe this has to be studied further, but my belief is unless these books can be found for a very small investment one might be wise to avoid these books. The Carol Danvers versus Ms. Marvel first appearance books may be indicative of this hypothesis.

The Future

I will continue to look at these types of analyses for film-related properties. I do not scoff at solid returns on comic books. The problem is that the more remote the character in a connected universe, the less the return one will see in their investment. The time frame to realize profits may also be less than it is for major characters. The Fantastic Four and X-Men are coming to the MCU so their books should increase in value. Will we see the same modest returns though for affiliated characters of those teams that we are now seeing in the data? In addition, will these less-key books retain their value for the long term? That is a question that will need to be evaluated.

Investors have become complacent in that most of the "hot" books are related to film and television developments. If one takes away the sales commissions and associated costs for selling these books sometimes there is very little meat left on the bone. The problem is that other sites give you the sizzle but ignore the steak (data). Use the GoCollect data tools to break down the numbers for different time frames can help you avoid missing the best times to sell books. You may determine that books you thought you should hold should now be sold, and vice versa. The data never lies.